In the world of financial markets, trading is a high-stakes endeavor where every decision can lead to profit or loss. To navigate these waters successfully, traders often turn to simulation as a powerful tool. Trading simulation allows traders to test their strategies and ideas in a risk-free environment, providing valuable insights and a safety net before engaging with real capital. In this article, we will delve into the concept of simulation in trading and how it can help traders hone their skills and strategies without financial risk.

What is Trading Simulation?

Trading simulation, also known as paper trading or virtual trading, is the practice of executing trades and managing a virtual portfolio in a simulated market environment. The key feature of trading simulation is that it does not involve real money. Instead, traders use virtual funds to mimic the trading experience, replicating market conditions and price movements in real time.

The Advantages of Trading Simulation

Risk-Free Learning: Trading simulation allows traders, especially beginners, to gain experience and confidence without the fear of losing real capital.

Strategy Testing: Traders can test their trading strategies, whether they are day trading, swing trading, or investing, to assess their effectiveness in different market conditions.

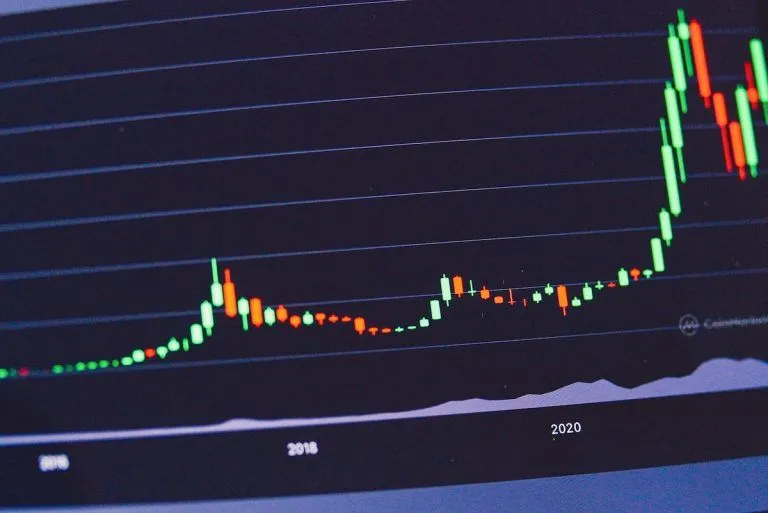

Asset Familiarization: Simulation enables traders to explore various asset classes, such as stocks, forex, commodities, and cryptocurrencies, without committing real funds.

Technical Analysis: Traders can practice technical analysis techniques like chart pattern recognition, trend analysis, and indicator application in real-time conditions.

Risk Management: Traders can experiment with different risk management techniques, including setting stop-loss and take-profit orders, to protect their virtual capital.

Market Psychology: Simulated trading provides insight into the psychological aspects of trading, helping traders manage emotions like fear and greed.

How to Get Started with Trading Simulation

Choose a Platform: Many online trading platforms and brokerages offer simulation accounts alongside live trading accounts. Select a reputable platform that suits your needs.

Create a Virtual Account: Sign up for a virtual trading account and set the initial virtual capital you wish to trade with. This capital is not real money, and any gains or losses are simulated.

Select Assets: Choose the financial instruments you want to trade, whether it’s stocks, currencies, commodities, or other assets.

Develop a Trading Plan: Establish clear trading objectives, strategies, and risk management rules before you begin trading in the simulation environment.

Execute Trades: Use the virtual trading platform to place simulated trades, adhering to your trading plan.

Analyze Results: Monitor the performance of your virtual portfolio and analyze the outcomes of your trades. Pay attention to what works and what doesn’t.

Adjust and Refine: Based on your simulation results, make adjustments to your strategies and risk management techniques. Continuously refine your approach.

Considerations and Limitations

Emotional Differences: Real trading often involves emotional pressure that simulation cannot fully replicate. Traders may experience different reactions when real money is on the line.

Slippage and Liquidity: Simulated trading may not accurately reflect real-world market conditions, including slippage and liquidity issues.

Overconfidence: Success in simulation does not guarantee success in live trading. Traders should avoid overconfidence and be aware of the differences between the two environments.

Conclusion

Trading simulation is an invaluable tool for traders of all levels. It provides a safe and educational way to test strategies, learn about market dynamics, and gain practical experience without risking real capital. By incorporating simulation into their trading routines, traders can refine their skills, build confidence, and improve their overall performance when they decide to transition to live trading.