Introduction to Trading Robots: A Systematic Approach ===

Trading robots have revolutionized the financial markets, enabling traders to automate their trading strategies and execute trades with precision and efficiency. These computer programs are designed to analyze market data, identify trends, and execute trades based on predetermined rules. However, with hundreds of trading robots available in the market, it can be overwhelming to choose the right ones and manage them effectively. In this article, we will explore the top 10 trading robots and discuss efficient management strategies to maximize their potential.

Top 10 Trading Robots: Efficient Management Strategies

- Research and Evaluation: Before selecting a trading robot, it is crucial to conduct thorough research and evaluation. Analyze the robot’s track record, performance metrics, risk management strategies, and user reviews. Look for robots that align with your trading objectives and risk tolerance.

- Diversification: It is essential to diversify your trading robot portfolio to reduce the risk of relying on a single strategy. Choose robots that operate in different markets, timeframes, or asset classes. This will help spread the risk and increase the chances of profitable trades.

- Regular Monitoring: Once you have selected your trading robots, it is important to regularly monitor their performance. Keep track of their trading activities, drawdowns, and profitability. Make necessary adjustments or replace underperforming robots with more promising ones.

- Risk Management: Implementing effective risk management strategies is crucial when using trading robots. Set appropriate stop-loss levels, risk-to-reward ratios, and position sizing rules. This will help protect your trading capital and minimize potential losses.

- Backtesting and Optimization: Before deploying a trading robot in live trading, backtest it using historical data to evaluate its performance. Optimize the robot’s parameters to enhance its profitability. This process will give you confidence in the robot’s ability to deliver consistent results.

- Adaptability: Markets are dynamic, and trading conditions can change rapidly. Choose trading robots that can adapt to different market conditions and adjust their strategies accordingly. Flexibility is key to ensuring consistent performance in various market environments.

- Continuous Learning: Stay updated with the latest market trends, news, and economic indicators. Monitor the performance of your trading robots and learn from their successes and failures. Continuous learning will help you refine your trading strategies and improve the performance of your robots.

- Broker Compatibility: Ensure that the trading robots you choose are compatible with your preferred brokers and trading platforms. Consider factors such as execution speed, data feed quality, and reliability. Seamless integration between the robot and the broker is crucial for efficient trading.

- Security and Reliability: When selecting trading robots, prioritize those developed by reputable companies or individuals. Ensure that the robots are secure, reliable, and have a proven track record. Avoid using unverified or suspicious robots that may put your trading capital at risk.

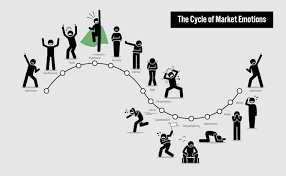

- Emotional Discipline: One of the main advantages of trading robots is their ability to remove emotional biases from trading decisions. However, it is still important for traders to maintain emotional discipline and avoid interfering with the robots’ trading activities. Trust in the system and let the robots execute their strategies without unnecessary intervention.

===

By following these efficient management strategies, traders can harness the power of trading robots to enhance their trading performance. Remember that trading robots are tools, and their effectiveness depends on proper management and continuous evaluation. Regularly review and adapt your trading robot portfolio to match changing market conditions and your evolving trading objectives. With a systematic approach, trading robots can prove to be valuable assets in your trading arsenal.